The Main Principles Of San Diego Home Insurance

The Main Principles Of San Diego Home Insurance

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Policy Plans

Value of Affordable Home Insurance

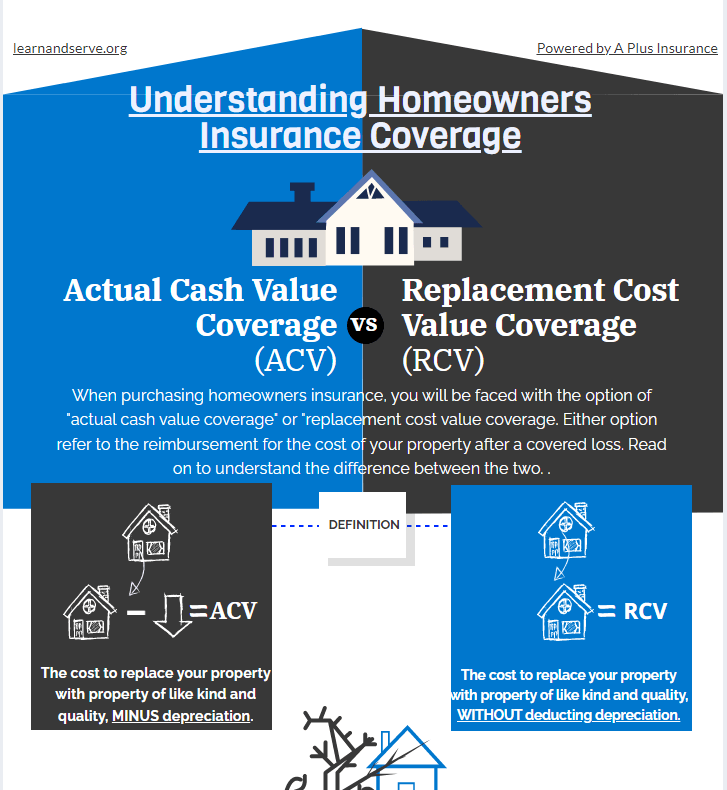

Safeguarding economical home insurance coverage is critical for protecting one's residential or commercial property and monetary health. Home insurance provides security against various threats such as fire, theft, natural calamities, and personal responsibility. By having a thorough insurance policy strategy in position, home owners can relax guaranteed that their most considerable financial investment is secured in case of unanticipated scenarios.

Inexpensive home insurance policy not only provides monetary protection but also offers satisfaction (San Diego Home Insurance). When faced with increasing residential or commercial property worths and construction costs, having a cost-effective insurance coverage guarantees that home owners can easily restore or repair their homes without encountering substantial financial burdens

Furthermore, cost effective home insurance can also cover individual possessions within the home, supplying reimbursement for items harmed or taken. This protection extends beyond the physical framework of your house, shielding the materials that make a house a home.

Insurance Coverage Options and Boundaries

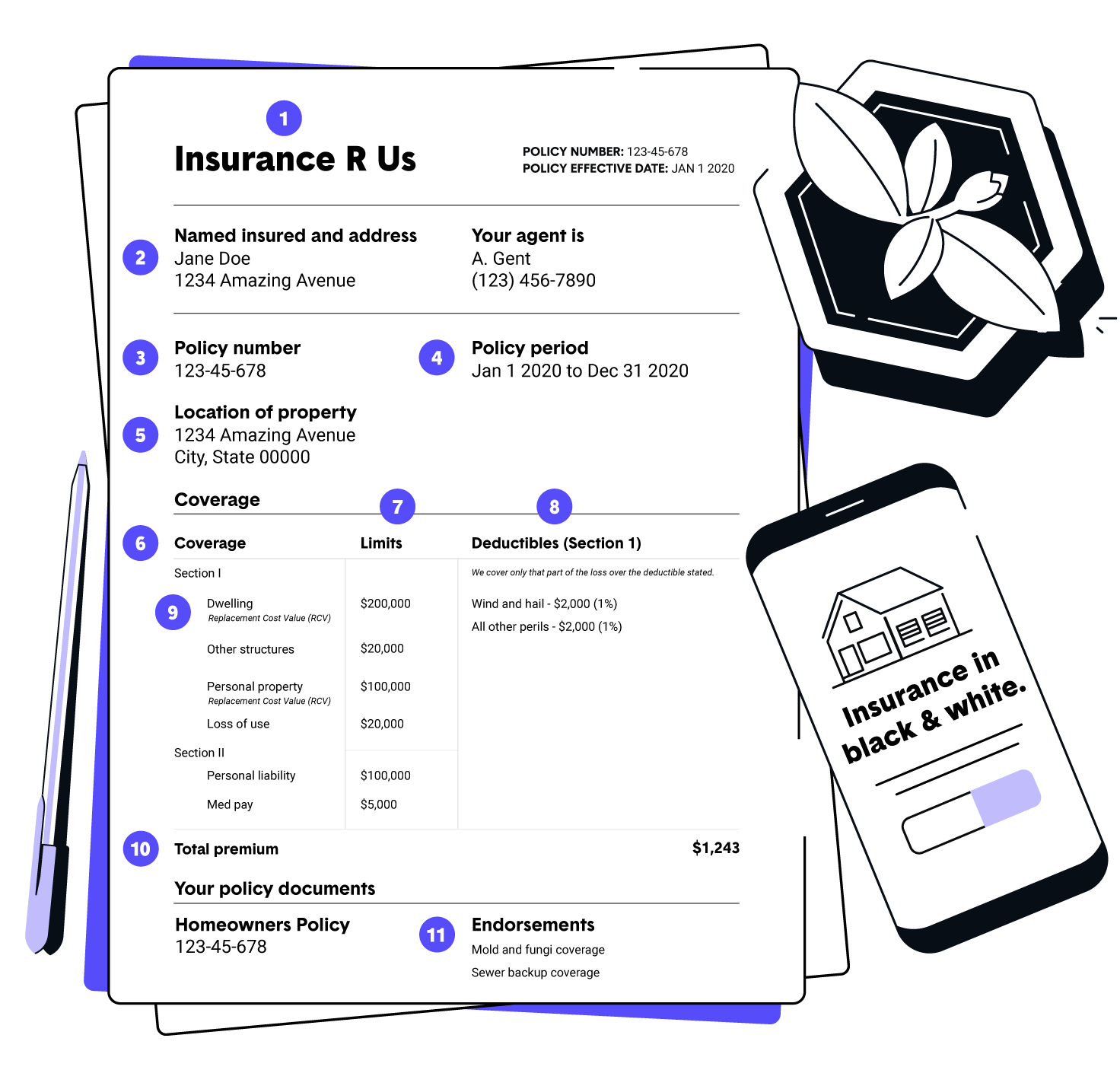

When it pertains to insurance coverage restrictions, it's crucial to comprehend the optimum amount your plan will certainly pay for each type of coverage. These restrictions can differ depending on the policy and insurance firm, so it's necessary to assess them carefully to guarantee you have adequate protection for your home and assets. By understanding the coverage options and limits of your home insurance coverage, you can make enlightened choices to secure your home and liked ones successfully.

Aspects Impacting Insurance Coverage Expenses

Numerous variables substantially affect the prices of home insurance plans. The place of your home plays a vital function in establishing the insurance policy premium.

In addition, the kind of insurance coverage you select straight affects the cost browse around here of your insurance coverage plan. Choosing for added coverage choices such as flood insurance policy or quake protection will certainly enhance your costs. Selecting higher protection restrictions will result in higher prices. Your insurance deductible amount can likewise influence your insurance expenses. A greater insurance deductible typically indicates reduced premiums, however you will certainly have to pay more out of pocket in the occasion of a case.

Additionally, your credit history, declares history, and the insurer you select can all influence the cost of your home insurance coverage. By thinking about these aspects, you can make informed decisions to aid handle your insurance policy sets you back properly.

Comparing Service Providers and quotes

Along with comparing quotes, it is vital to review the credibility and economic security of the insurance policy companies. Seek consumer testimonials, rankings from independent firms, and any background of complaints or regulatory activities. A reputable insurance coverage service provider need to have a good performance history of promptly refining cases and offering superb client service.

Moreover, think about the particular insurance coverage attributes used by each company. Some insurance companies may supply fringe benefits such as identification burglary protection, tools malfunction coverage, or insurance coverage for high-value items. By carefully contrasting i thought about this quotes and companies, you can make an informed choice and pick the home insurance strategy that finest satisfies your needs.

Tips for Conserving on Home Insurance

After extensively comparing companies and quotes to locate the most ideal protection for your demands and budget, it is sensible to explore efficient strategies for minimizing home insurance policy. One of one of the most significant methods to save money on home insurance policy is by bundling your policies. Several insurance business supply discounts if you buy several plans from them, such as combining your home and automobile insurance. Enhancing your home's protection measures can likewise result in cost savings. Setting up security systems, smoke detectors, deadbolts, or an automatic sprinkler can minimize the threat of damage or burglary, possibly decreasing your insurance premiums. Additionally, maintaining a good credit rating can favorably affect your home insurance coverage rates. Insurance firms often consider credit report background when identifying premiums, so paying bills on schedule and managing your debt sensibly can cause reduced insurance policy prices. Frequently evaluating and updating your plan to show any changes in your home or conditions can guarantee you are not paying for insurance coverage you no longer requirement, helping you conserve money on your home insurance costs.

Verdict

Finally, securing your home and loved ones with budget friendly home insurance policy is essential. Recognizing coverage limitations, alternatives, and factors affecting insurance coverage expenses can help you make informed choices. By contrasting companies and quotes, you can discover the ideal policy that fits your demands and budget plan. Applying ideas for minimizing home insurance policy can likewise help you secure the essential security for your home without damaging the financial institution.

By deciphering the intricacies of home insurance policy strategies and exploring useful methods for protecting cost effective coverage, you can go to this web-site make sure that your home and enjoyed ones are well-protected.

Home insurance policies commonly provide a number of coverage alternatives to secure your home and valuables - San Diego Home Insurance. By understanding the coverage choices and restrictions of your home insurance policy, you can make enlightened choices to secure your home and loved ones successfully

Regularly assessing and updating your policy to show any type of changes in your home or conditions can guarantee you are not paying for coverage you no longer need, assisting you conserve cash on your home insurance policy premiums.

In final thought, protecting your home and liked ones with cost effective home insurance policy is essential.

Report this page